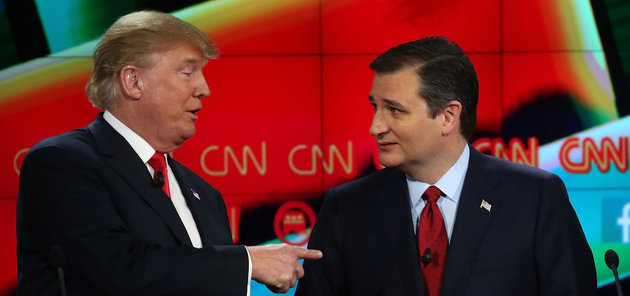

WASHINGTON -- As Donald Trump continues to dominate GOP primary polls, establishment Republicans have been reluctantly warming to the idea that Sen. Ted Cruz (R-Texas) might be their only alternative to the racist billionaire.

At least Cruz, the reasoning goes, supports traditional Republican policies. Trump could upend the party's leadership structure and policy agenda, reshaping the GOP into something like the neo-fascist political parties that have gained ground in Europe over the past few years.

But that argument makes one significant assumption -- namely, that Cruz actually does support a policy agenda acceptable to the class of executives, financial elites and party honchos who make up the Republican establishment. In reality, a key plank of his economic platform would horrify them: Cruz supports a return to the gold standard, a relic of the pre-Depression past that would wreak havoc on the American business class, and on the rest of society too.

"I think the Fed should get out of the business of trying to juice our economy and simply be focused on sound money and monetary stability, ideally tied to gold," Cruz said in an October debate.

He reiterated the call two weeks later. "We had a gold standard under Bretton Woods, we had it for about 170 years of our nation’s history, and enjoyed booming economic growth and lower inflation than we have had with the Fed now," Cruz said at a Nov. 10 debate. "We need to get back to sound money."

No country on Earth now relies on a gold standard for its currency.

A 2012 survey of economists conducted by the University of Chicago's Initiative on Global Markets found literally no support for the gold standard among any of its respondents. These were not all liberals in love with deficit spending and robust regulation. Seven of the economists came from the notoriously conservative Chicago school itself.

"A gold standard regime would be a disaster for any large advanced economy," University of Chicago economist Anil Kashyap told the researchers, adding that support for the idea "implies macroeconomic illiteracy."

"There are much better ways to avoid excessive inflation, while maintaining the flexibility of a fiat currency," said University of Chicago economist Nancy Stokey.

Under a gold standard, a country pegs the value of its currency to a certain amount of gold. If you own dollars, you can trade them in to the government for a fixed amount of gold. This was appealing to ancient and medieval peoples who fetishized a shiny metal with limited practical use. But it turned out to be a disaster for major developed economies.

"In the late 19th century, the Gilded Age robber barons and big bankers thought the gold standard very modern," University of Texas at Austin economist James Galbraith told The Huffington Post in an email. "I congratulate Senator Cruz; his economics is perfectly in line with his worldview."

The price of gold is notoriously volatile. That irregularity can be destructive, and can make it very difficult for business leaders to plan their affairs. Say the price of gold drops 10 percent because a new mine is discovered, and speculators fuel a downward spiral in prices. If the dollar is pegged to the price of gold, that means the value of the dollar just dropped 10 percent because someone dug a hole in the ground.

That creates a mess for any business with international operations, especially if the United States is the only country on the gold standard. If the dollar gets cheaper, it effectively becomes less expensive to pay workers in dollars. Maybe, then, it would be time to open a factory in Arkansas and shift production away from Vietnam. That's great for profits, until gold surges anew in value -- at which point suddenly all of your U.S. workers, getting paid in gold-backed dollars, are expensive again.

It's an even bigger problem for the stock market. If dollars are tied to gold, then so are all the other financial assets that are denominated in dollars. The stocks and bonds of major U.S. corporations would end up fluctuating with the whims of a speculative market for gold. Without any change in its basic operations or prospects, a U.S. company could see the value of its shares plunge or skyrocket. This unpredictability would encourage investors to put their money in more stable foreign projects.

"Every country in the world went off the gold standard for a reason," says economist Dean Baker, co-director of the Center for Economic and Policy Research. "It was inconsistent with normal economic policy."

Yet the gold standard does have its adherents, and Cruz is getting some financial support for his quixotic monetary move. A new political ad group called the Lone Star Committee is trying to raise $1 million for a New Hampshire ad blitz promoting the gold standard. This is not an establishment Republican group. It's being run by Richard Danker, who previously worked as a policy adviser at the obscure conservative think tank American Principles in Action. Danker managed the 2014 Senate campaign of Jeff Bell, who was routed by Sen. Cory Booker (D-N.J.). APA is chiefly underwritten by the anti-gay financier Sean Fieler.

Former Rep. Ron Paul (R-Texas) has been perhaps the most prominent advocate of the gold standard in recent decades, using his perch in Congress to excoriate the Federal Reserve and demand a return to "hard money." He now appears in TV ads warning of a looming financial crisis in which "stocks and bonds will crash" and "the savings of millions will be wiped out." In these ads, Paul encourages viewers to buy a book written by one Porter Stansberry, a man whom, it turns out, the Securities and Exchange Commission once successfully sued for securities fraud.

Ron Paul's son Rand, a senator from Kentucky now vying for the 2016 GOP nomination, is a bit more restrained than Cruz in his criticism of central banking. During a November debate, he spoke of the need to "re-examine" whether the Fed should be "determining interest rates," but he stopped short of calling for a full return to the gold standard.

Hardcore anti-government libertarians tend to like the gold standard because it takes economic power away from central bankers and hands it over to financial markets. For many libertarians, a net loss in government power is a net gain in freedom. But Cruz's gold-standard pitch isn't just a play for the general libertarian vote. It's an appeal to a very specific kind of libertarian who believes in particularly weird things.

Milton Friedman was an extreme libertarian who opposed the licensing of physicians on the grounds that such government meddling was harming the market for doctors. Yet on the subject of the gold standard, not even he was as much of a hawk as Cruz.

Friedman's greatest work was a 1963 book he co-wrote with Anna Schwartz, titled A Monetary History of the United States. In it, Friedman and Schwartz make a persuasive case that the gold standard actually caused the Great Depression.

In the early years of the Depression, currency speculators and worried citizens extracted huge sums of gold from government coffers by trading in their dollars, concerned that the government would not be able to support the value of the currency. The Fed responded with a single action that protected its gold reserves, the value of the dollar and the integrity of the gold standard: It raised interest rates. Doing so offered citizens a potentially greater return on their holdings of U.S. dollars, since higher interest rates mean better returns on savings accounts.

It worked. The dollar grew stronger and the run on American currency abated. But by encouraging people to save, the Fed was discouraging people from spending, curtailing the total amount of money available in the general economy. This, Friedman argued, turned an economic problem into a calamity. When everybody is broke, the last thing you want to do is limit the supply of money. Without money, nobody is going to get out of being broke.

President Franklin D. Roosevelt solved this dilemma in 1933 by taking the U.S. off the gold standard. That freed up the Fed to adjust the money supply based purely on broader economic conditions, without regard to how many pounds of gold it might secure by doing so. Roosevelt allowed foreign governments to continue to cash in dollars for gold, but that last vestige of the gold standard was abolished by President Richard Nixon in 1971.

Today, gold standard adherents consist mainly of cranks, crackpots and devotees of the Austrian school of economics. And the years since the financial crisis have devastated the intellectual underpinnings of the Austrian school. Austrian goldbugs began warning in 2009 that hyperinflation was just around the corner, because based on the Austrian money model, it should have been. But hyperinflation never happened.

The Cato Institute's Mark Calabria is one of the few serious economists who supports a gold standard. When he talked about it on Glenn Beck's show in 2011, he had to share airtime with a conspiracy theorist from the John Birch Society who once produced a film on chemtrails and wrote a book arguing that vitamin B-17 -- which is actually a poison, not a vitamin -- can cure cancer. Still, Calabria and this guy were able to agree about gold.

The Republican establishment came to terms with accepting votes from the tinfoil-hat brigade a long time ago. But the GOP donor class has never allowed such people to set the party's economic agenda. A Cruz nomination might change that.

- Publish my comments...

- 0 Comments